State-by-State Paid Family and Medical Leave Legislation: An Employer’s Guide

By Kristin Hostetter, CPDM

By Kristin Hostetter, CPDM

Sr. Product Manager, Absence Management

Lincoln Financial Group

By Marissa Mayfield, MBA

Sr. Product Manager, Statutory Disability & PFL

Lincoln Financial Group

By Patricia Zuniga, JD, LLM

Compliance Consultant

Lincoln Financial Group

Paid family and medical leave (PFML) is being legislated at all levels of government. To understand how to comply with these laws, we will review the types of mandated paid leave and look at ways to dissect various laws, including taking a deep dive into Washington state’s PFML that begins paying benefits in 2020.

Understanding State-Mandated Paid Leave

States generally have three main types of mandated paid leave: paid family leave (PFL), paid medical leave (PML), and paid sick leave (PSL). State programs may provide for one or more of these program types. Both PFL and PML typically provide wage replacement and job protection. Leave reasons include bonding, caring for a family member, a qualified military exigency in some cases and, in the case of PML, an employee’s own serious health condition. These mandated leaves may overlap with corporate paid leave programs, requiring close coordination.

PSL laws commonly require employers to either provide paid sick leave to employees who previously did not have any or mandate how employees must be allowed to use employer-sponsored paid sick leave.

Why Is Paid Family and Medical Leave a Hot Topic Right Now?

Several factors are driving more states to consider and adopt PFL/PFML laws. To start, the workforce is changing. Older employees are delaying retirement, and Millennials have become the largest generation in the workforce.1,2 As a result, employers must meet a wide range of needs across multiple generations holding different expectations for benefits, time off, and compensation.

An estimated 43.5 million U.S. adults (18.2%) report being caregivers, and over half report being employed during a portion of their caregiving.3 Employee caregivers have more health problems.4 Leave to care for a family member is a workplace productivity issue that employers must address.

The United States is the only developed nation without mandated paid maternity leave.5 As people become more aware of this, they become more vocal about the need for paid leave benefits. In the absence of a response by the federal government, some states are responding by introducing legislation to mandate PFL, and in some cases PFML. Extending paid maternity leave helps not only with employee retention but with the health and overall wellness of both mothers and children. Some employers have introduced or enhanced their paid leave programs. In highly competitive job markets, employers must rely on robust benefit packages to attract and retain talent.

How Do Employers Prepare for State-Mandated PFML?

Preparing for PFML may seem overwhelming, especially for employers that must comply with multiple state laws. An employer can segment these compliance complexities into four basic steps.

- Understand the PFL/PFML program characteristics and your employer responsibilities.

- Engage business partners and employment counsel.

- Determine how the program interacts with other leave and paid benefits, and communicate this to employees.

- Train managers on PFML.

Program Characteristics

While program design and benefits may vary among both passed and pending PFL/PFML laws, employers can focus on a core set of program elements to understand implications of a given law: Does the law apply to your organization? What are the employee eligibility requirements? What conditions trigger the program? What are the benefit’s duration and amount?

Let’s consider an actual PFML law and apply these questions. Washington’s PFML law began requiring employers to begin collecting premiums on Jan. 1, 2019, and begin paying benefits on Jan. 1, 2020. Breaking the law down into meaningful components provides additional clarity.

- Employer eligibility: All private-sector employers are included. Organizations with fewer than 50 employees are exempt from paying the employer share of the premium.

- Employee eligibility: Employees are eligible for family and medical leave benefits after working for at least 820 hours during the first four consecutive quarters out of the last five or the most recent four quarters out of the last five.6

- Triggering conditions:

- Family leave, including bonding with a newborn, adopted, or foster child under age 18; caring for a family member with a serious health condition; and assisting a loved one when a family member is deployed abroad on active military service

- Medical leave to care for an employee’s own serious health condition

- Benefit duration:

- Family leave is available for up to 12 weeks.

- Medical leave is available for up to 12 weeks and may be extended two weeks for employees with a pregnancy-related serious health condition that results in incapacity.

- Combined family and medical leave may be taken for up to 16 weeks or 18 weeks for employees with a pregnancy-related serious health condition that results in incapacity.

- Benefit amount: If the employee’s average weekly wage is 50% or less of the state average weekly wage, the benefit is 90% of his or her average weekly wage. If the employee’s average weekly wage is greater than 50% of the state average, the benefit is 90% of his or her average weekly wage up to 50% of the state average, in addition to 50% of his or her average weekly wage that is greater than 50% of the state average.

Answering these questions helps put some framework around duration and benefit amounts. For employers in multiple states, this is vital as more PFML laws are passed. In addition to design, employers need to understand how a program is administered:

- How is the program funded?

- How is the program administered (e.g., state-run, private plans, etc.)?

- What information does the state require to demonstrate compliance with the law?

Intersection with Other Programs

PFL/PFML may intersect with many other programs, including federal FMLA, state FML, statutory disability, short-term disability, PSL, company paid and unpaid leaves, and personal time off/sick time. When evaluating how these programs work together, consider:

- concurrency (when PFML can run at the same time as another program such as FMLA);

- employee eligibility requirements for each program and the right time to apply them;

- benefit sequencing (e.g., a pregnancy that moves from a disability claim to a bonding period);

- coordinating payments (e.g., a PSL law or company-sponsored sick time benefit is payable during the waiting period for PFML); and

- limiting overlap of benefits.

Additional preparations include revising company policies to avoid conflict with PFL/PFML laws, ensuring flexibility with any company-sponsored paid or unpaid leaves, tracking entitlements and payments, and developing robust employee and manager training.

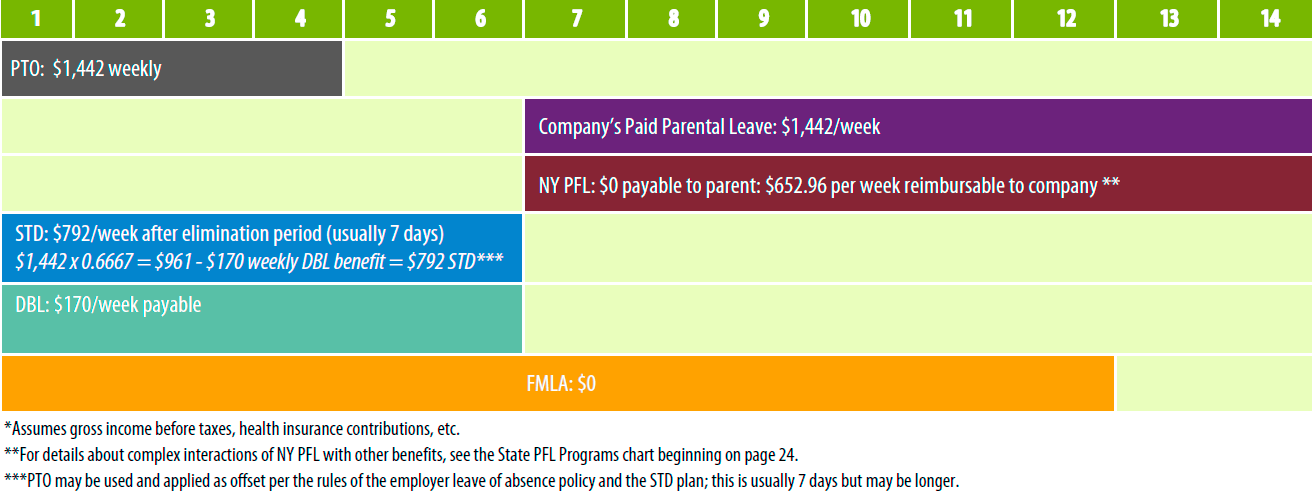

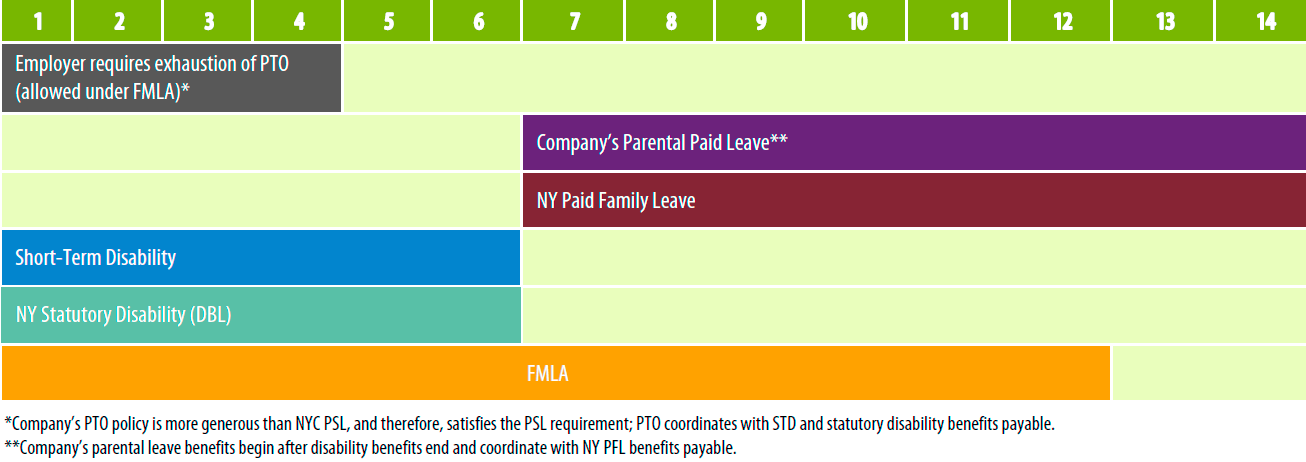

Let’s take a look at an example of how various policies, including state-mandated PFL, may work together. The charts below provide a view of leave entitlement for a pregnancy claim in New York City showing how the benefits coordinate, assuming an average salary of $75,000.

Chart 1: Coordination of Benefits New York State PFL: 14 Weeks of Leave Following Childbirth

Chart 2. Benefit Summary New York Employee Following Childbirth ($75,000 annual salary or $1,442 weekly)*

Planning and Engagement

Understanding a PFL/PFML law’s program characteristics and how it may intersect with other programs can be quite an undertaking for an individual employer. The good news is that many of an employer’s vendors and business partners are also preparing for these new laws and are ready to share information.

If a state allows a private or “voluntary” plan, ask your carrier or third-party administrator about participation requirements and other basic information about these laws. Understanding the eligibility requirements for a given law may prompt a conversation with your payroll or human resource information system vendor to ensure you have the mechanisms in place to determine eligibility and perform necessary benefit calculations.

When you have specific questions, always engage legal counsel to help ensure readiness for new PFL/PFML laws.

Conclusion

Stay in the know about PFL/PFML legislation. Breaking down laws to understand the program characteristics and taking time to learn about how they interact with other leaves and paid benefits will set your organization up for success. Review the chart of state PFL programs for specific program information about current and pending PFL/PFML laws. As these laws continue to evolve, you’ll want to stay connected to the state websites listed in the chart and add new resources for new state laws.

References

- Pew Research Center. More Older Americans Are Working, and Working More, Than They Used To. Retrieved from http://www.pewresearch.org/fact-tank/2016/06/20/more-older-americans-are-working-and-working-more-than-they-used-to/.

- Pew Research Center. Millennials Are the Largest Generation in the U.S. Labor Force. Retrieved from http://www.pewresearch.org/fact-tank/2018/04/11/millennials-largest-generation-us-labor-force/.

- National Alliance for Caregiving and AARP. 2015 Caregiving in the U.S. June 4, 2015.

- MetLife Mature Market Institute. Caregiving Employees Health Problems Can Cost U.S. Companies a Potential $13.4 Billion Yearly. (Press Release). Mature Market News. February 2, 2010.

- OECD. Key Characteristics of Parental Leave Systems. Retrieved from https://www.oecd.org/els/soc/PF2_1_Parental_leave_systems.pdf.

- Administration of Washington’s new PFML law is still under development. At this writing, there is no confirmed process for releasing Washington PFML eligibility information to a new employer for a new employee’s PFML rights that were accrued under a former employer. To learn more, employers can call the Washington PFML Customer Care Team at 833.717.2273.